Colliers. EMEA Capital Markets Snapshot | Q3 2021

A resurgence of ambitious deal-making in many European markets continues into Q3 2021.

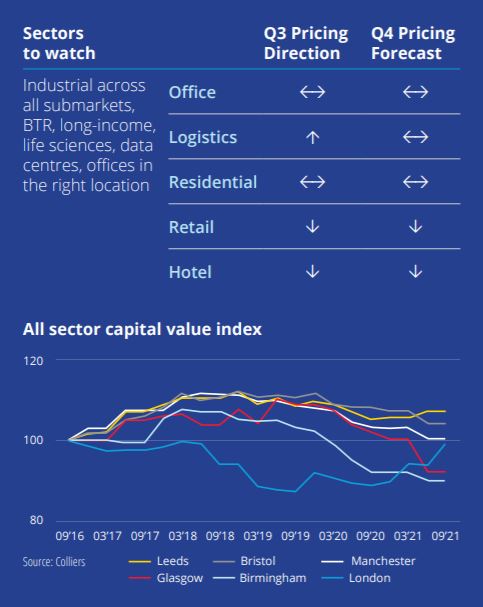

It is increasingly clear that investors view reports of the death of the office as much exaggerated, with milestone office deals concluded this quarter in tier-one cities such as Frankfurt, London and Milan. Core locations in capital cities remain the key investor focus in Europe’s largest economies, particularly in the office sector, but second-tier cities are also attracting attention.

Logistics assets continue to act as an investment magnet amid the e-commerce revolution and supply chain challenges thrown up by the pandemic. Appetite for hard-hit retail and hospitality properties is still relatively subdued, but bright spots are beginning to emerge, such as Spain’s hotel sector. Both retail and institutional investors continue to demonstrate interest in the residential and particularly the build-to-rent (BTR) sector. Access the full report below.

Download the research

Add a Comment